Phantom is not a central replace and it has no responsibility to report to the new Irs. Phantom is a non-KYC unit, definition they won’t also assemble personal information to their pages, very quite often, they don’t have one advice to statement at all. For more information, listed below are some all of our help guide to staking taxation. Cryptocurrencies such as bitcoin are handled while the property by many people governments up to the nation—including the U.S.

Simultaneously, it’s crucial that you observe that purchases to the Solana blockchain are in public areas obvious and you will long lasting. Before, the newest Irs has worked which have designers such as Chainalysis to research blockchain deals and you can crack upon tax fraud. If you have put Divly in the previous step, the brand new taxation data might possibly be automatic according to the country’s tax legislation.

You are required to declaration your funding development, losses, and income from Phantom. This informative guide covers the major areas of crypto tax within the The newest Zealand, and trading, mining, staking, NFTs, and you may DeFi. We’ll talk about each kind away from nonexempt enjoy plus the costs from which each one is taxed, and we’ll render investors in the nation suggestions and you can strategies to own reducing its crypto tax debts. This article discusses taxation implications for selecting, selling, and you may generating crypto inside the Greece. We defense all nonexempt incidents, the certain taxation consequences, just how although in order to document, and then we are some methods for cutting your crypto goverment tax bill. To have taxation aim, the newest Internal revenue service treats digital possessions, as well as extremely non-fungible tokens (NFTs), while the possessions.

Discover income tax cost, reporting criteria, and strategies to minimize your own crypto taxation responsibility. Crypto is phantom wallet solana regarded as a variety of individual wide range (such as dollars or shares away from stock) inside the Switzerland, and how it’s taxed utilizes regardless if you are categorized since the an exclusive private otherwise a specialist individual. Even though Coinbase Specialist might have been deprecated (since December 2023), of numerous pages still need to transfer their historical positions to make certain an entire and you may precise taxation statement. Wake up Taxation helps CSV imports away from Coinbase Professional for this purpose.

- Particular procedures are neutral and do not want reporting, even though future events between the same property you are going to.

- Rather than yourself sorting as a result of purses, exchanges, and spreadsheets, the software pulls your transaction records, can be applied costs base steps, and you can generates compliant taxation reports.

- Of many cryptocurrency traders fool around with extra transfers, wallets, and you can networks beyond Phantom.

- This is a place to publish one advice, development, otherwise general questions relating to Phantom.

Faqs in the Phantom Purse Taxes: phantom wallet solana

Crypto activity to your Phantom or other networks are at the mercy of taxation. Phantom doesn’t keep the finance otherwise wanted Discover Their Customer (KYC). When you’re Phantom doesn’t are accountable to the brand new CRA, the pastime can nevertheless be tracked for individuals who move crypto inside the and you will of a central replace. Phantom does not share research on the ATO otherwise thing taxation forms. When you are Phantom doesn’t are accountable to the brand new ATO, it’s possible that their pastime will likely be monitored if you transfer to/of a centralized exchange. Phantom is actually an excellent Solana-centered crypto wallet offered while the a web browser expansion and you will cellular.

If you’re unable to report your own crypto purchases truthfully, you can face really serious effects. They’ve been cryptocurrency tax audits, severe monetary penalties, plus violent income tax analysis. You have to statement extremely crypto deals while the nonexempt events.

🇳🇿 The whole Crypto Taxation Guide For new Zealand in the 2025

We’ll talk about ideas on how to report, what you should declaration, and when to help you report, and particular simple methods for lowering your annual tax bill. NFT royalties take-strings costs made to creators when their digital artwork is resold. Even after getting paid-in crypto, the brand new Irs snacks these repeating royalty avenues while the ordinary team money, perhaps not financing gains, and requires serious creators in order to statement him or her for the Plan C of Function 1040. This article tend to walk you through classifying their NFT royalty income, maintaining best info, and you can truthfully reporting your income to remain Internal revenue service-certified. The brand new Irs features obvious regulations, the brand new reporting models, and sharper investigation nourishes out of exchanges. Studying the basics—category, taxable situations, reporting dates, and you can 2025’s Form 1099-DA—kits your up to remain compliant and you may save money due to wise considered.

Try crypto staking advantages nonexempt?

Sure, basically, for those who trading cryptocurrencies on the Phantom, you have taxation debt. These types of are different according to the country and its particular certain crypto income tax legislation. Certain jurisdictions can offer tax exemptions based on profit number otherwise holding cycle. You’ll owe fees to your winnings created from attempting to sell NFTs and may also deduct losses occasionally.

Filing crypto taxes doesn’t have to be overwhelming, even if you fool around with an excellent decentralized wallet for example Phantom. That have Awaken Tax, you might streamline the method, be sure conformity, and you will save your time. Begin making preparations your crypto fees now making taxation 12 months worry-100 percent free. You’ll need to determine whether for each and every exchange led to a return or losings. To own more information about how exactly these transactions is actually taxed on your own nation, we recommend contacting Divly’s crypto income tax books.

Enforcement are expanding, and more crypto profiles are becoming income tax notices and you may straight back taxation needs.Neglecting to report your own crypto progress can cause fees and penalties, attention fees, and you will HMRC analysis. You will generate your own development, loss, and you may income tax account from the Fantom investing hobby from the hooking up your bank account which have CoinLedger. Link your account from the posting your data through the means talked about lower than.

Divly helps you transfer all of your deals to your you to set, automate the fresh income tax calculations, and create a taxation report nearby to suit your country. For those who discover a type 1099-K otherwise Setting 1099-B of a good crypto replace, the brand new Internal revenue service likely understands that you have reportable cryptocurrency deals. This fact stems from the new “matching” mechanism stuck on the Irs Information Reporting Program (IRP). The fresh expanded deadline to help you file 2021 taxation (Oct 17th, 2022) is approaching soon.

Contrary to popular belief, this can save lots of Irs worries. Cryptocurrency loss can also be offset growth and reduce your current tax liability. It’s crucial to declaration one another progress and you may losses accurately to make sure you’re also perhaps not overpaying taxation. Reporting crypto taxation is far more difficult than you may believe.

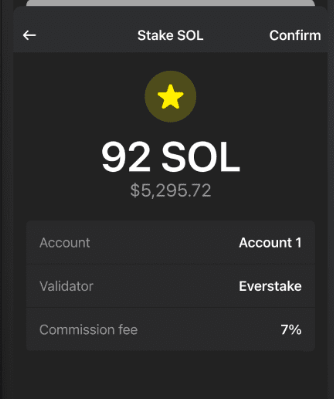

Phantom lets profiles to hang and you may risk SOL and you will interact with decentralized software to your Solana. After you also have a couple of tokens to an automated-market-creator (AMM) for example Uniswap otherwise Bend, you receive LP (liquidity-provider) tokens you to tune your own specialist-rata share of one’s pool. If your market price of your own few floats when you are the financing sit in the newest pool, the brand new mixture of tokens lso are-balances. Weighed against only “HODLing,” it means you end up which have a lot fewer of one’s admiring token and a lot more of your depreciating you to definitely.

- We’ll discuss simple tips to statement, what you should statement, and if to report, and certain easy strategies for cutting your annual taxation costs.

- The new Internal revenue service food digital assets because the assets, thus procedures for example exchange, earning advantages, otherwise transferring assets can result in money progress or income tax debt.

- Perhaps you along with exchange for the Coinbase otherwise secure attention from BlockFi.

- Always make certain the most up-to-date transactions is shown on the brought in history.

- As a result all crypto transaction you participate in—if it’s exchange, selling, or making perks—have tax ramifications.

- Again, this can be rather easy and the majority of taxpayers have been used to help you.

These types of loss is offset your earnings and may also boost your full income tax reimburse. You wear’t need to pay fees for the crypto if you wear’t sell or dispose of it. For those who’lso are possessing crypto that has gone up within the well worth, you have a keen unrealized acquire. When you promote, change, exchange, or else dispose of the fresh crypto, you then’ll features a good taxable enjoy. Sure, having fun with crypto to cover one thing are an excellent nonexempt enjoy one brings a funds get.