- Cryptocurrency market analysis march 2025

- Best cryptocurrency to buy april 2025

- Cryptocurrency news april 2025

Latest cryptocurrency news april 2025

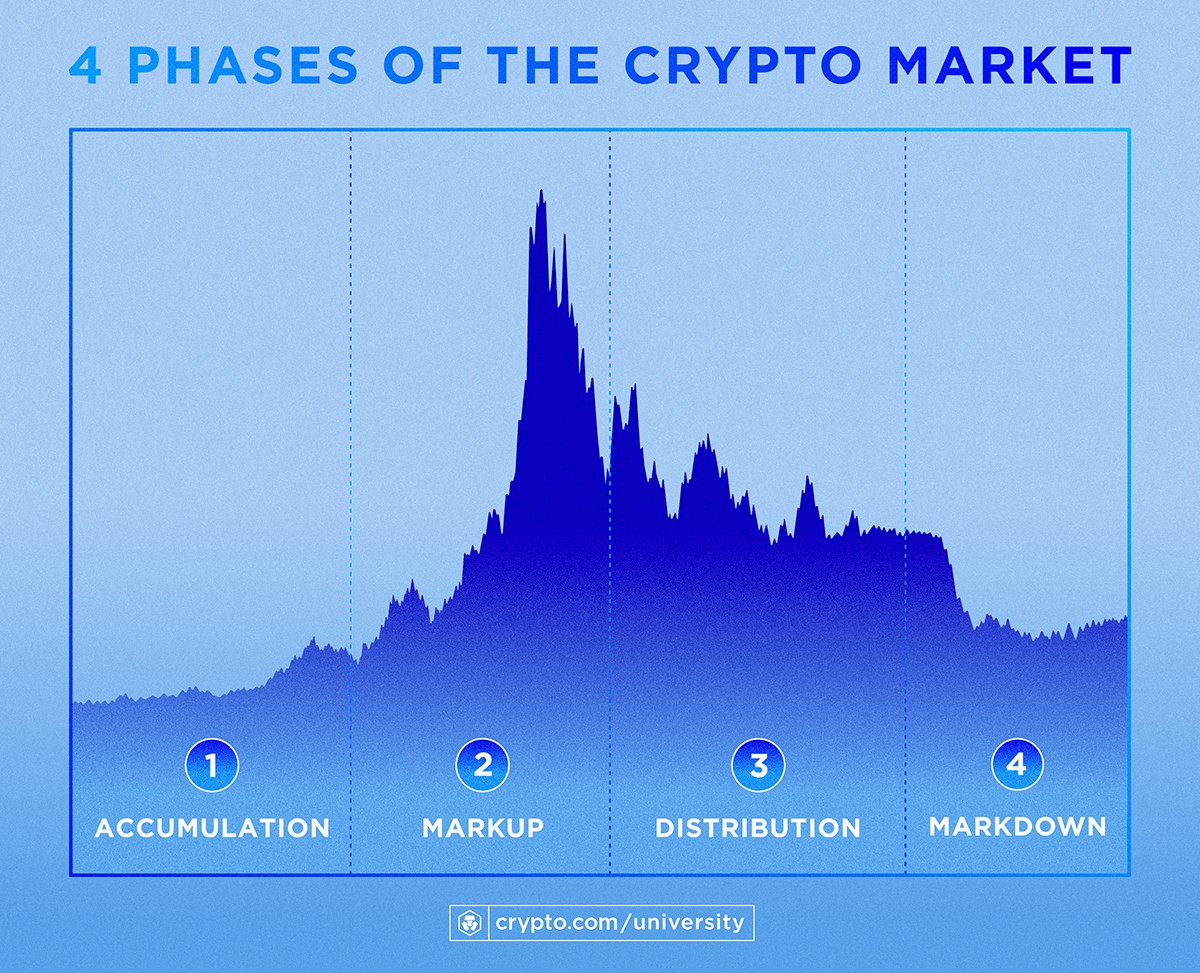

With the bull market getting ready for recovery, a number of cryptos are showing signs of bullish momentum building up as we anticipate a bullish phase in the next few days or weeks https://aussie-play.org/.Here are a number of cryptos to watch in April, with the potential to realise huge profits.

The sentiment in the cryptocurrency market is predominantly bullish, fueled by positive news regarding regulatory advancements and technology adoption. Analysts predict that both Bitcoin and Ethereum could experience further price hikes as demand for blockchain solutions increases. Market analysts suggest that if Bitcoin breaches the $80,000 mark, it may trigger a wave of new investments that could propel it even higher. For Ethereum, the widespread adoption of smart contracts is expected to sustain upward momentum. Monitoring trends in market sentiment will be crucial for potential buyers looking to make informed choices.

Broader market trends may heavily influence the price performance of NEAR. First and foremost, institutional adoption will be pivotal in driving demand for NEAR. This interest from institutions is a pre-requisite for NEAR to move to our higher target, but also potentially exceed it and move well beyond $7 in 2025.

Cryptocurrency market analysis march 2025

That’s the million dollar question top of mind of every crypto investors. We address this question, in a detailed way in our crypto research service. You may want to check out our recent alerts (by scrolling down); they emphasize our focus on finding the best tokens, way before they start running higher, looking for the best timing to enter top tokens.

That’s the million dollar question top of mind of every crypto investors. We address this question, in a detailed way in our crypto research service. You may want to check out our recent alerts (by scrolling down); they emphasize our focus on finding the best tokens, way before they start running higher, looking for the best timing to enter top tokens.

BTC chart analysis for 2025 – The longest term Bitcoin price chart shows that BTC is finally clearing $100k. BTC is now consolidating around the median of its very long term rising channel. The probability that our BTC forecasted prices, both support and bullish targets, will be hit in 2025 is very high.

With improving macroeconomic conditions and the recent cooling of US inflation, the cryptocurrency market appears poised for potential further recovery. However, caution remains warranted as global trade tensions and policy decisions continue to influence market sentiment.

The important Fibonacci level of $1.104 will play a pivotal role in determining its bullish potential. Institutional adoption and advancements in real-world asset integration could drive ONDO‘s growth, with significant upside potential if key levels are surpassed.

Beyond its price, Bitcoin’s role as a strategic reserve asset is gaining traction. Speculation about nation-states adopting Bitcoin, especially in times of geopolitical uncertainty, could transform its utility in global finance.

Best cryptocurrency to buy april 2025

TRON was founded in 2017, and TRX was initially valued at $0.0019 per token. At its peak in 2018, TRX spiked as high as $0.2245, for a gain of 11,715% in a matter of months. TRX is currently valued around $0.24.

The crypto presale is currently in its 28th stage, with over 504 million $TICS tokens sold to 23,900+ holders, raising an impressive $15.5 million. At $0.1430 per token, Qubetics is presenting an incredible opportunity for early investors.

Cryptocurrency is treated as a capital asset, like stocks, rather than cash. That means if you sell cryptocurrency at a profit, you’ll have to pay capital gains taxes. This is the case even if you use your crypto to pay for a purchase. If you receive a greater value for it than you paid, you’ll owe taxes on the difference.

Despite the bullish structure, caution is warranted. Historically, Ethereum outperforming Bitcoin has often led to a market pullback. Additionally, a surge in leverage suggests that short liquidations are driving the price up rather than organic demand.

Cryptocurrency news april 2025

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.

The stars appear to be aligning. From historical accumulation cycles to Bitcoin dominance reversal patterns and analyst price targets, the signs are all there. If you’re still in the crypto space, this is not the time to exit. Instead, it might be the most strategic moment to position for the upcoming wave. Altcoin season 2025 may be the most explosive cycle yet — so keep an eye on its chart pattern and latest crypto news.

The cryptocurrency market is seeing a surge in AI tokens, cryptocurrencies linked to AI ventures such as blockchain protocols and decentralized machine learning platforms. Search volume for “AI tokens” has grown exponentially in 2024, indicating strong investor interest (Exploding Topics). This trend reflects the growing intersection of AI and blockchain, with platforms using tokens to pay for services or reward users.

Blackstone reported first-quarter profits exceeding estimates on April 17, 2025, but its CEO highlighted potential disruptions from tariffs (Reuters). Other financial news includes the approval of Capital One’s acquisition of Discover by U.S. regulators and Citigroup’s first-quarter net income of $7.4 billion (Investopedia). Globally, Indian markets saw top firms like HDFC Bank and Airtel add $46 billion in market capitalization, reflecting renewed optimism (Financial Express).

At the same time, the its Dominance chart (BTC.D), is signaling bearish reversals. We have clear RSI divergence (lower highs on RSI and Bitcoin price are creating higher highs), a rejection from a rising wedge, and dominance has failed to break the 64-67% strong resistance zone.